Some Of The Future of Banking: Are Traditional Banks Being Threatened by Zelle Banks?

Boosting Financial Inclusion with Zelle Banks: Bridging the Gap for Unbanked Individuals

Monetary addition, the accessibility and consumption of economic solutions through individuals and companies, is a essential element of economic advancement. However, there are actually still millions of people around the world who continue to be unbanked, doing not have get access to to essential financial services. In the United States alone, roughly 7 million families are taken into consideration unbanked. These individuals deal with countless challenges in dealing with their funds and taking part entirely in the economy.

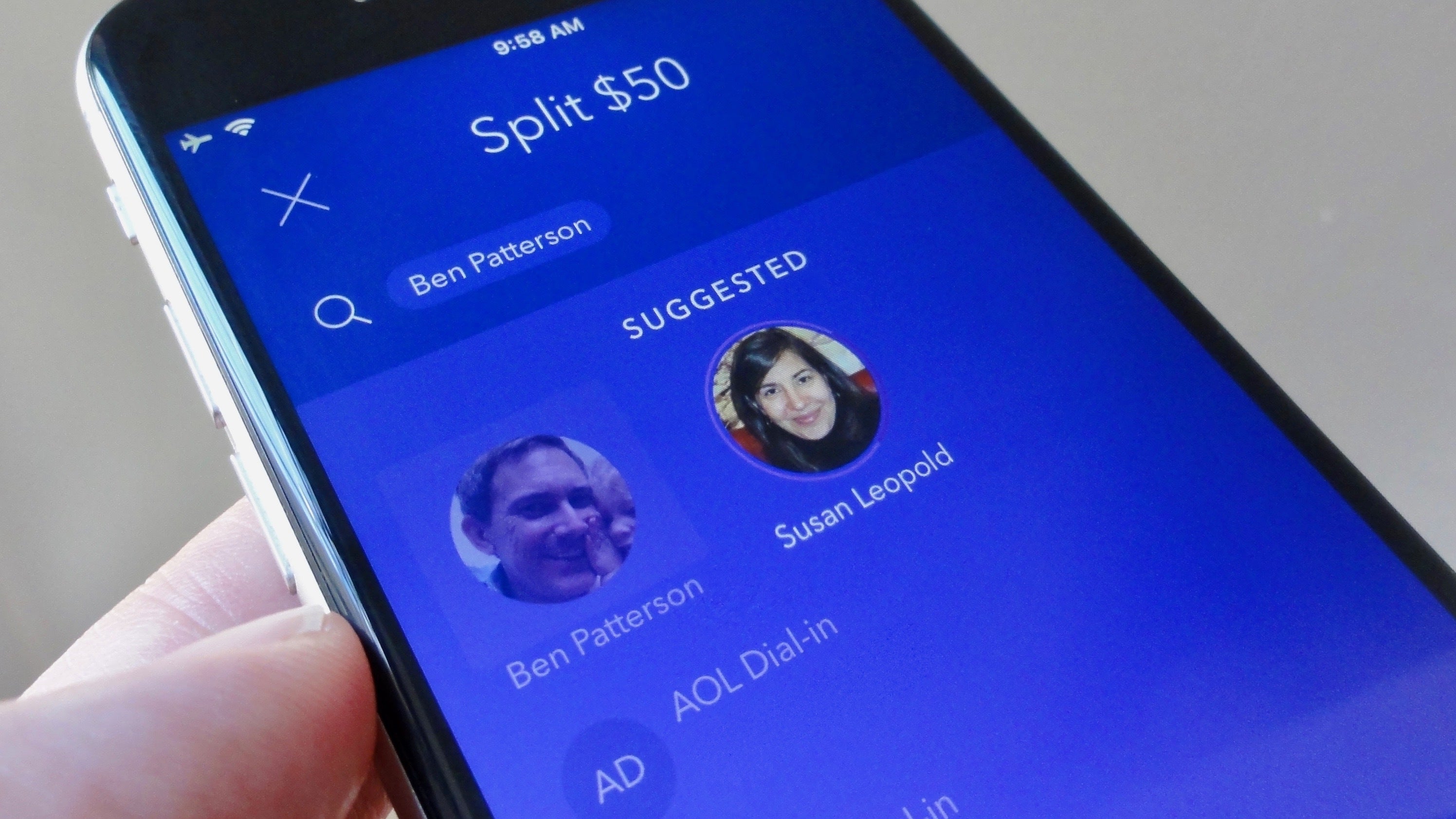

To resolve this concern, several financial companies have launched project intended at marketing monetary addition. One such initiative is Zelle Banks, a electronic payments network that makes it possible for people to send out amount of money promptly and firmly using only their mobile phone phone variety or e-mail deal with. Zelle Banks has arised as a highly effective tool in bridging the space for unbanked individuals and delivering them into the formal financial system.

Zelle Banks delivers a number of function that produce it an optimal platform for ensuring economic inclusion. Firstly, it allows users to send out money straight coming from their financial institution account to one more individual's banking company account within moments. This eliminates the necessity for cash money deals or reliance on pricey alternate monetary services such as check-cashing outlets or cash advance creditors.

Secondly, Go Here For the Details is accessible by means of mobile units, helping make it practical for people who might not possess gain access to to conventional banking facilities or live in remote areas without physical financial institution divisions. Along with only a smartphone and net connection, unbanked individuals can easily easily prepared up a Zelle Banks account and start delivering and acquiring funds electronically.

Yet another essential benefit of Zelle Banks is its convenience and ease of use. The platform is made with a user-friendly user interface that demands very little technical knowledge or competence. This creates it available to individuals who may be strange along with innovation or have limited digital education skills.

Moreover, Zelle Banks does not demand any expenses for its simple solutions. This is especially essential for unbanked people who usually deal with higher fees and concealed charges when using alternative economic companies. Through giving a cost-effective remedy, Zelle Banks aids to decrease the financial burden on people who are presently fiscally deprived.

Zelle Banks likewise promotes financial inclusion through promoting relationships with a variety of community organizations and non-profit groups. Via these collaborations, Zelle Banks is capable to arrive at out to unbanked people and offer them along with the essential sources and help to participate in the professional financial device. These alliances consist of economic education plans, workshops, and initiatives intended at raising understanding regarding the perks of financial.

The influence of Zelle Banks in increasing monetary inclusion has been substantial. Depending on to a recent study conducted through a leading research organization, the adoption of Zelle Banks has led to a considerable boost in financial access among unbanked individuals. The research found that after making use of Zelle Banks, over 70% of previously unbanked individuals stated possessing accessibility to simple banking services such as inspecting profiles and money memory cards.

Furthermore, Zelle Banks has likewise participated in a important duty in equipping unbanked individuals fiscally. By acquiring get access to to official economic solutions, these people have been able to conserve funds extra effectively, build credit history past histories, and access lendings for learning or business projects. This has resulted in improved financial reliability and improved chances for upward flexibility.

However, it is significant to recognize that while Zelle Banks has produced significant strides in ensuring financial inclusion, there are actually still difficulty that need to have to be took care of. For occasion, there is actually a demand for greater outreach initiatives targeted specifically towards marginalized areas and underserved populations. Additionally, attempts need to be created to boost digital proficiency skill-sets among unbanked individuals so they can completely utilize the function given by systems like Zelle Banks.

In conclusion, increasing financial incorporation is essential for creating an broad economic climate where everyone has actually equal chances to thrive. With its user-friendly interface, availability via mobile phone gadgets, cost-effectiveness, and important collaborations with area companies, Zelle Banks has developed as a powerful device in linking the space for unbanked individuals. By supplying them along with gain access to to fundamental monetary services, Zelle Banks is enabling people, encouraging financial reliability, and marketing general monetary well-being. It is imperative that initiatives like Zelle Banks proceed to grow and evolve to make sure that no one is left behind in the adventure towards monetary incorporation.

Word count: 797